Tech Shares Steer Surge as S&P 500 Aims for Consecutive Record High

- 24 January 2024 8:53 PM

Tech companies dictated the upward trajectory of the stock market on Wednesday, despite a mid-day stagnation. Leading the winners, the Nasdaq Composite (^IXIC) experienced a slight decrease in gains from over 1% to approximately 0.5% by afternoon trading. This moderation in growth can be attributed to robust earnings reports, primarily from Netflix. Other tech behemoths, Microsoft (MSFT) and Meta (META), also saw their stocks ascend.

The S&P 500 (^GSPC) grew about 0.3% to build on the new record closing height, achieved on Tuesday. This growth puts the index on a trajectory towards another record closure, which would be its fourth consecutive. The Dow Jones Industrial Average (^DJI), on the other hand, traded flat.

Furthermore, outstanding updates from chip gear manufacturer ASML (ASML) and software supplier SAP (SAP) fuelled optimism for a chip industry rebound and a tech boom powered by Artificial Intelligence (AI).

Tesla (TSLA), despite being a laggard, remained the focus amid a flurry of corporate reports. The Electric Vehicle (EV) manufacturer is under scrutiny due to its delivery performance in a competitive market with fierce rivals, particularly in China. Legendary tech firm IBM (IBM) was also in the spotlight.

In parallel with the spotlight on earnings report, discussions about the Federal Reserve's potential interest rate cuts continue behind the scenes.

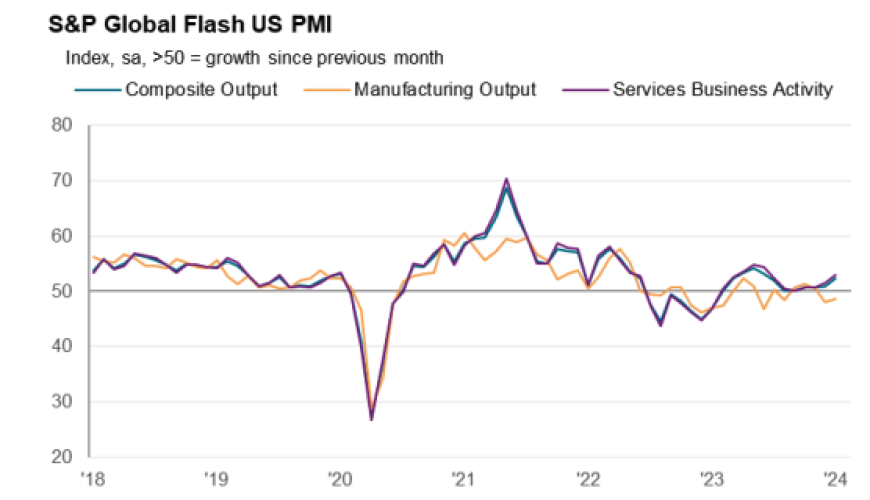

Strong updates on US manufacturing and services activities, indicating the highest economic output in seven months, are driving expectations. These updates have significant implications, especially with the release of the Fed-preferred PCE inflation figures set for Friday, and the preliminary reading of Q4 GDP expected on Thursday.

Investor Peter Mallouk spotlights an encouraging statistic for hesitant investors, stating that money invested during market peaks tend to outperform than when invested at any other time. Mallouk disapproves the belief that what goes up must come down, asserting that the overall trend of broad stock indexes has shown consistent growth. He further stresses the importance of keeping invested capital active, indicating that those not investing are more likely to fare worse than those who invest and must subsequently navigate a struggling market.

Among the notable stock trends in Wednesday afternoon trading were Nvidia (NVDA) which saw a 4% rise, continuing the AI-powered rally. Also, Dutch chipmaker ASML reported a three-fold increase in orders.

Netflix (NFLX) shares soared as much as 14% on the back of a surge in Q4 subscriber additions that exceeded the company’s predictions.

AMD shares showed a similar trajectory, up by over 5% following an upgrade from analyst Pierre Ferragu at NewStreet Research.

Microsoft (MSFT) shares also responded positively in the afternoon, climbing above 1% after the company momentarily reached a $3 trillion market cap.

However, some analysts have cautioned that Netflix's ballooning valuation may not sustain its impressive subscriber growth rate as it intensifies its crackdown on password sharing. Despite acknowledging the streamer's strong performance, Morningstar analyst Matthew Dolgin opined that the stock might have gone ahead of itself. Danish Bank also expressed concern, downgrading its rating to Hold from Buy while indicating a peak in EPS growth in 2024.