How it works

-

Fill our simple formFill out one easy form and your inquiry will be submitted to our large network of lenders. Loan amounts range from $100 to $5,000

-

Receive different loan offersReceive and review different loan offers and terms

-

Review & accept your loan offer that best suits your needSelect and accept a loan that works for you.

-

Money is deposited directlyThe funds are usually deposited within 1 business day.

Latest Finance NewsMore news

-

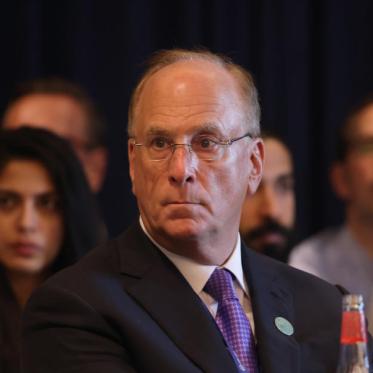

Larry Fink lashes out at BlackRock's political critics: They 'continuously lie'

-

US cities’ mansion taxes see mixed results

-

Antitrust fervor is gripping Washington and Silicon Valley. But lawsuits have been declining.

-

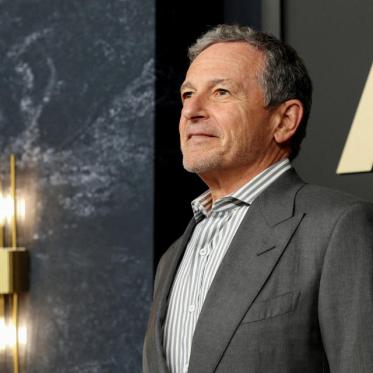

Disney's 'million-dollar question' post-proxy fight: Who will succeed Bob Iger?

-

New Masters Apple Vision Pro app gives golf fans whole new way to experience the tournament

United States Personal Loan Directory

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Puerto Rico

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

About

Get the Best Loans USA Deals Today!

Are you looking for the best loans USA to help you achieve your financial goals? With a myriad of loan options available, it can be overwhelming to navigate the lending landscape. This comprehensive guide will help you understand the different types of loans, factors affecting loan approval, tips for choosing the right financial institution, and the loan application process. Get ready to find the perfect loan to make your dreams a reality!

Key Takeaways

- Explore the variety of loan programs available in the USA, from personal loans to mortgages.

- Understand key factors affecting loan approval such as credit score, income and employment status, debt-to-income ratio.

- Compare different loan options to find best fit for financial situation. Consider reputation and trustworthiness when selecting lender.

Types of Loans Available in the USA

In the diverse world of lending, there is a loan for virtually every financial need. The four main types of loans available in the USA are:

Each loan type caters to a specific financial goal, offering competitive rates and flexible terms to suit a wide range of borrowers.

So, whether you need funds to consolidate debt, starting a business, buying a car, or purchasing a home, there is a variety of loan programs out there tailored to your needs.

Personal Loans

Personal loans are versatile financial instruments that can be used for a variety of purposes, such as debt consolidation, home improvement, or emergency expenses. These loans often come with fixed monthly payments and competitive interest rates. The best part? Many lenders, like U.S. Bank, have no origination fees, no prepayment penalties, and checking your rate won’t impact your credit score.

Your debt-to-income ratio and credit usage also play a significant role in determining your eligibility for a personal loan. To estimate your monthly payments, you can use tools like the U.S. Bank personal loan calculator, which provides an estimate based on a few simple inquiries.

For example, if you need to take out a $10,000 loan for 36 months to fund your home improvements, the associated monthly payment would be $314.47 with an APR of 8.24%. This payment can automatically be taken from either your personal checking or savings account.

Business Loans

Business loans are essential for entrepreneurs looking to start or expand their ventures. Small Business Administration (SBA)-guaranteed loans, for instance, can be used for various purposes, such as long-term fixed assets and operating capital.

Keep in mind, these loans are not free money – they come with an obligation to repay with interest. To qualify for a business loan, your business must:

- Have a satisfactory credit history

- Be physically located and operating within the United States or its territories

- Meet specific eligibility requirements based on income, ownership, and operating area.

Even businesses with poor credit histories may be eligible for startup funding.

Auto Loans

Auto loans are designed to help individuals purchase or refinance a new or used vehicle. Factors such as credit score, income and employment, and debt-to-income ratio are taken into account when considering loan approval. A comparison of different loan options can help you secure the best deal in terms of interest rates, loan terms, and related fees and charges.

Whether you’re buying your first car or upgrading to a newer model, auto loans can provide the financial assistance you need to make that purchase possible. Just remember to shop around and compare loan options to find the best fit for your financial situation.

Mortgages

Mortgages are loans that assist homebuyers in financing their dream homes. They offer a selection of loan terms and interest rates to accommodate a variety of financial situations. The loan term denotes the duration of the loan repayment period, while the interest rate is the percentage of interest charged on the loan.

Understanding the different types of mortgages available can guide you to an informed decision when choosing a loan that best suits your needs. With the right mortgage, you’ll be one step closer to owning your dream home.

Understanding Loan Approval Factors

Understanding the factors that lenders consider during the approval process is pivotal to successfully securing a loan. These factors encompass credit score, income and employment, and debt-to-income ratio.

Familiarity with these aspects can better prepare you for the loan application process and enhance your chances of approval.

Credit Score

Your credit score is a numerical expression reflecting your creditworthiness and predicting your credit behavior, such as the likelihood of you repaying a loan in a timely manner. Having a high credit score can increase the likelihood of loan approval, as well as provide access to more favorable interest rates and terms. Conversely, a low credit score can make it difficult to obtain loan approval and may lead to higher interest rates and unfavorable terms.

Improving your credit score is possible by:

- Making timely payments

- Lowering your credit card balances

- Limiting the number of loans you take out

- Reviewing your credit report for errors and disputing any inaccuracies to boost your score.

Income and Employment

Stable income and employment history play a crucial role in securing a loan. Lenders need to confirm that you have the capacity to repay the loan, and a longer employment history may raise your chances of approval. Additionally, your debt-to-income ratio and credit score are critical factors in loan approval, with a favorable ratio and a strong credit score increasing the likelihood of being approved for a loan.

By maintaining a stable job and reliable income, you demonstrate to lenders that you are a responsible borrower, increasing your chances of loan approval and access to better loan terms.

Debt-to-Income Ratio

Your debt-to-income ratio is a percentage that compares the amount of debt you have to your income. It is calculated by dividing your monthly debt payments by your gross monthly income. A lower debt-to-income ratio indicates that you have a better ability to manage and repay loans.

Maintaining a low debt-to-income ratio can not only increase your chances of loan approval but also allow you to secure more favorable loan terms. Keeping this ratio in check is essential for a successful loan application and healthy financial management.

Comparing Loan Options

When it comes to choosing the right loan, comparing your options is key. By considering factors such as interest rates, loan terms, and fees and charges, you can make an informed decision on the best loan for your specific financial needs.

Interest Rates

Interest rates, also known as annual percentage rate, are the cost of borrowing money, expressed as a percentage of the principal amount charged by a lender to a borrower. They vary based on credit score, loan type, and financial institution. Borrowers with higher credit scores typically receive lower interest rates, while those with lower scores may face higher rates.

Shopping around and considering different financial institutions when comparing loan options can help secure the most beneficial interest rates. By doing so, you can save money on the total cost of your loan and make your repayments more manageable.

Loan Terms

Loan terms refer to the parameters associated with borrowing money, such as the loan’s repayment period, the interest rate, and any applicable fees. These terms can affect the monthly payment and total cost of the loan, depending on the interest rate, repayment period, and fees associated with the loan.

Selecting terms that align with your financial situation and budget is a crucial step when choosing a loan. Comparing various loan options will help you identify the most advantageous deal and ensure that your loan remains manageable throughout its duration.

Fees and Charges

Being aware of fees and charges associated with loans is essential to avoid unexpected costs. These may include origination fees, prepayment penalties, late fees, and other associated charges.

Thoroughly reading the loan agreement and inquiring about any fees or charges that are not explicitly stated can prevent unexpected costs. By understanding the full cost of your loan, you can make an informed decision and avoid any unwelcome surprises down the line.

Tips for Choosing the Right Financial Institution

Selecting the right financial institution is critical to ensure a secure and reliable loan experience. By considering factors such as reputation, customer service, and online accessibility, you can confidently choose a lender that best suits your needs and provides a smooth loan process.

Researching the lender’s reputation and customer service is important when selecting a financial institution that is a member FDIC.

Reputation and Trustworthiness

The trustworthiness and reputation of a financial institution are essential components to consider when choosing a lender for your loan. A good reputation and being seen as trustworthy can be beneficial in cultivating strong relationships with customers, partners, and other stakeholders.

When researching the trustworthiness and reputation of financial institutions, consider the following:

- Reviews from other customers

- Assess the institution’s financial ratings

- Review any complaints or lawsuits that have been filed against the institution

- Research the institution’s history and track record to ensure they have provided reliable services

Customer Service

Excellent customer service is paramount in navigating the loan process smoothly and ensuring that you get the most advantageous loan options. LendingClub, for example, offers Rewards Checking, an award-winning checking account that offers 1% cash back, ATM rebates, and other advantages.

Other institutions may provide features such as online banking, customer support, and loan calculators for their customers. By prioritizing institutions with outstanding customer service, you can ensure that you have the necessary support and guidance throughout the loan process, making it an enjoyable and hassle-free experience.

Online Accessibility

User-friendly online platforms are becoming increasingly important in today’s digital age, as they allow for easy loan management and application. Opting for institutions with accessible online platforms can make the loan process more convenient and efficient.

When selecting an institution with a user-friendly online platform, consider one that:

- is compliant with the Web Content Accessibility Guidelines (WCAG)

- has screen reader compatibility

- offers keyboard navigation

- has a high contrast mode

These features ensure that the online platform is accessible to all users, regardless of their abilities or limitations.

Loan Application Process

Navigating the loan application process can seem daunting, but with the right guidance, it can be a breeze. By following the steps of prequalification, application submission, and final approval and funding, you can secure the financial assistance you need to achieve your goals.

The loan application process begins with prequalification, which involves providing basic information

Prequalification

Prequalification is the process of assessing a potential borrower’s creditworthiness and determining the maximum loan amount they may be eligible for. This typically involves a soft credit check, which does not impact your credit score. The lender will review your credit report and other financial information to assess your eligibility and the terms of the loan.

The benefits of prequalification include:

- Assessing the amount you may be eligible to borrow

- Assessing the terms of the loan

- Comparing loan options

- Making a well-informed decision

Application Submission

Submitting a complete and accurate loan application is crucial for a smooth approval process. The documents and information required for application submission may vary depending on the type of loan and the lender. Generally, proof of identity, proof of income, and other financial documents are necessary. Additionally, a copy of your credit report may be needed.

Ensuring the accuracy of information and the inclusion of all required documents is essential when submitting an application. Additionally, it is advisable to read the loan terms and conditions carefully prior to submission. Prompt submission of the application may increase the likelihood of approval.

Final Approval and Funding

Upon final approval, you will need to review the loan agreement and receive funding to fulfill your financial needs. The final approval process involves the lender reviewing all the necessary documentation to determine whether to approve the loan. Upon approval, the funding process entails the disbursement of the loan funds to the borrower, thus concluding the loan process and allowing the borrower to receive the necessary funds.

By understanding the loan agreement, you can make informed decisions concerning your loan and ensure that you are fully aware of the terms and conditions of your loan. With the funds in hand, you can now focus on achieving your financial goals.

Summary

In conclusion, finding the best loans in the USA requires understanding the different types of loans available, assessing loan approval factors, comparing loan options, choosing the right financial institution, and navigating the loan application process. By following the guidance provided in this comprehensive guide, you can confidently secure the financial assistance you need to achieve your dreams. Remember, the key to finding the perfect loan is to research, compare, and make well-informed decisions, so don’t hesitate to start your journey towards financial success today!

Frequently Asked Questions

What is the easiest loan to get in America?

The easiest loans to get are payday loans, no credit check loans, and pawnshop loans; however, they come with high interest rates and fees.

How can I borrow $200 from cash App?

You can borrow up to $200 from Cash App by opening the Cash App, selecting Borrow if available, clicking Unlock to view your loan offer, choosing your desired amount and repayment option, then reading and accepting the loan agreement.

How to get loans?

Qualify for a bank loan, compare rates, submit your application, review the loan agreement and receive your funds to get a loan.

What factors should I consider when choosing a financial institution for a loan?

When choosing a financial institution for a loan, ensure that it has a good reputation, excellent customer service, and online accessibility to ensure you have a secure and reliable loan experience.

How can I improve my credit score to secure better loan terms?

To improve your credit score and secure better loan terms, make timely payments, lower your credit card balances, limit loans taken out, and review your credit report for errors.